| ||||||

| Llamas graze at Machu Picchu |

Thursday, December 19, 2013

I'm not saying it was aliens, but...

We had a great time at Machu Picchu and a full review of our trip will be coming up, but here's one of the standout pictures! The llamas are really cool.

Saturday, December 14, 2013

Amex Platinum Downgrades its Benefits, Offers Compensation to Some- I Got a Rock.

Word has recently spread through the points and miles community that Amex Platinum was losing the benefit of access to American and United Airlines lounges. Lucky covered it here. Well, the long and short of it is that Amex has been offering various amounts of "compensation" to affected cardholders, from $200 to $500 statement credits. At least, that was what was offered in the first round of e-mails. Yesterday, I received my notification. Here's what they told me:

Yep, I got a rock. Thanks, Amex. Thanks a lot for taking away a benefit and "easing the sting" by reminding me about a benefit that I already had. This is definitely a net loss in value for the card and I plan to downgrade as soon as the new year rolls around.

|

Changes to the Airport Club Access Program

|

| We realize this is an inconvenience to you and your business, so we would like to remind you about the $200 Airline Fee Credit4 benefit.* You may receive up to $200 a year in statement credits when incidental fees, such as baggage fees, flight-change fees, in-flight food, and beverages are charged by the airline to your Business Platinum Card. If you haven’t already done so, enroll and select a qualifying airline. Every January, you have the option to update your airline selection. |

Yep, I got a rock. Thanks, Amex. Thanks a lot for taking away a benefit and "easing the sting" by reminding me about a benefit that I already had. This is definitely a net loss in value for the card and I plan to downgrade as soon as the new year rolls around.

Wednesday, December 11, 2013

Peru Rail- Ollantaytambo to Machu Picchu and Return

Because Macchu Picchu is in a pretty remote area, the only option for reaching it is by foot or by train. Since treks have to be arranged far in advance and take several days, we opted to take the train. Peru Rail runs several routes to Aguas Calientes (Machu Picchu Pueblo); from Cusco, Urubamba, and Ollantaytambo. The Ollantaytambo train takes the least amount of time at around an hour and a half. We chose that train.

Though many people stay overnight in Cusco, Urubamba, or Ollantaytambo and take a morning train into Aguas Calientes, we chose to take an afternoon train from Ollantaytambo and overnight in Aguas Calientes. For a short trip like ours, that option gives you the most time to enjoy Machu Picchu itself, because buses begin running at around 5:30 and the site opens around the same time.

We booked the "Vistadome" service and arrived at Ollantaytambo station to board train Vistadome 603 for our trip 3:27 PM trip to Aguas Calientes.

The train itself was fairly nondescript but comfortable for a short trip. Seats are assigned at ticketing, and we were fortunate enough to be seated near the front of the first car, which meant that we had a good view out of the front window.

An interesting aspect to our trip was that we shared the ride with a film crew from "Strip the City" a Science Channel show that's going to be doing an episode on Machu Picchu. They set up cameras:

And filmed all aspects of the trip from the station:

The scenery:

To the engineer himself:

And just because I sometimes like to be meta, I took a picture of someone who decided to film the film crew:

I'll be awaiting the episode (mid-March, maybe) with great anticipation.

Anyway, the scenery along the ride is pretty magnificent:

Even if the "snack" served is not:

The snack was a roll with peppers and cheese and tea or soda and was included in the price of our ticket (approx. $55 one-way). After descending from the high desert down into the jungle, we rounded a bend and got our first look at Aguas Calientes, perched on the banks of the Urubamba River.

When we pulled into the station, we caught a glimpse of the far more expensive and fancy "Hiram Bingham" train that runs from Cusco to Aguas Calientes. Maybe next time...

Though many people stay overnight in Cusco, Urubamba, or Ollantaytambo and take a morning train into Aguas Calientes, we chose to take an afternoon train from Ollantaytambo and overnight in Aguas Calientes. For a short trip like ours, that option gives you the most time to enjoy Machu Picchu itself, because buses begin running at around 5:30 and the site opens around the same time.

We booked the "Vistadome" service and arrived at Ollantaytambo station to board train Vistadome 603 for our trip 3:27 PM trip to Aguas Calientes.

The train itself was fairly nondescript but comfortable for a short trip. Seats are assigned at ticketing, and we were fortunate enough to be seated near the front of the first car, which meant that we had a good view out of the front window.

An interesting aspect to our trip was that we shared the ride with a film crew from "Strip the City" a Science Channel show that's going to be doing an episode on Machu Picchu. They set up cameras:

And filmed all aspects of the trip from the station:

The scenery:

To the engineer himself:

And just because I sometimes like to be meta, I took a picture of someone who decided to film the film crew:

I'll be awaiting the episode (mid-March, maybe) with great anticipation.

Anyway, the scenery along the ride is pretty magnificent:

Even if the "snack" served is not:

The snack was a roll with peppers and cheese and tea or soda and was included in the price of our ticket (approx. $55 one-way). After descending from the high desert down into the jungle, we rounded a bend and got our first look at Aguas Calientes, perched on the banks of the Urubamba River.

When we pulled into the station, we caught a glimpse of the far more expensive and fancy "Hiram Bingham" train that runs from Cusco to Aguas Calientes. Maybe next time...

Tuesday, December 10, 2013

Adventures in Manufactured Spending- UPDATE

UPDATE: A reader has pointed out that physical gift cards are no longer available on the Sony site. Only e-giftcards. That seriously compromises the value of this deal since cardpool will only pay 70% for e-gift cards. You still earn a profit, but only $2.80 per card. That's probably not worth the effort for most folks. Anyway, here's how the deal would work now:

1. Sync card to Twitter @ sync.americanexpress.com.

2. Tweet "#AmexSony Spend w/ synced Card & receive credit."

3. Click-thru Topcashback to earn 5% back on Sony purchases

4. Purchase $100 Sony gift card, pay with Synced Amex ($25 will post 1-2 days after transaction posts)

5. Once GC arrives, sell to Cardpool.com for $70 after click-thru from Topcashback (earning 4% on the sale)

Sale price ($70) + statement credit ($25) + purchase rebate ($5) + Cardpool rebate ($2.80) = $102.8 for a profit of $2.80 per card.

Original post is below the jump.

1. Sync card to Twitter @ sync.americanexpress.com.

2. Tweet "

3. Click-thru Topcashback to earn 5% back on Sony purchases

4. Purchase $100 Sony gift card, pay with Synced Amex ($25 will post 1-2 days after transaction posts)

5. Once GC arrives, sell to Cardpool.com for $70 after click-thru from Topcashback (earning 4% on the sale)

Sale price ($70) + statement credit ($25) + purchase rebate ($5) + Cardpool rebate ($2.80) = $102.8 for a profit of $2.80 per card.

Original post is below the jump.

Bluebird Website Changes- How to Withdraw Funds

Many people use Amex's Bluebird card (a prepaid card that can be loaded with Vanilla Reloads) as a means of managing funds and generating miles. A common tactic is to purchase reloads with a miles earning card, load the funds to Bluebird, and pay that (or another) credit card bill from Bluebird's bill pay service. However, sometimes it's easier to simply withdraw the funds to your linked checking account, an option that Bluebird has always allowed.

However, since Bluebird keeps "improving" its site, the link for withdrawing money has moved around a bit. Well, the latest iteration moves the link again, but this time it's much easier to find. Now you simply log in and click the "My Account" tab at the top of the page:

This will take you to, er, well, the "My Account" page. Now go down to the bottom where Amex has added the intuitive "Withdraw Funds" link.

That takes you to your withdrawal options, where you can simply transfer funds out as before.

However, since Bluebird keeps "improving" its site, the link for withdrawing money has moved around a bit. Well, the latest iteration moves the link again, but this time it's much easier to find. Now you simply log in and click the "My Account" tab at the top of the page:

This will take you to, er, well, the "My Account" page. Now go down to the bottom where Amex has added the intuitive "Withdraw Funds" link.

That takes you to your withdrawal options, where you can simply transfer funds out as before.

Sunday, December 8, 2013

Manufactured Spending: Trimming Costs with the Fuel Rewards Network

Anyone who regularly engages in Manufactured Spending should be fully aware of the actual cost of their spending. For example, if you buy $1000 in Visa gift cards at Winn-Dixie, you'll pay $11.90 in purchase fees. If you then liquidate through purchasing money orders, the you'll likely pay another $0.70 in purchase fees. That brings your actual cost for spending $1,011.90 to $12.60. So, with a single miles card you're paying 1.26 CPM. With a 2% cashback card, you're making .74% profit. With the 2.2% Barclay Arrival card, your profit (in the form of travel credits) goes up to .94%.

Winn-Dixie also participates in the Fuel Rewards Network, a loyalty card system that pays off in cents-off per gallon (CPG) of gasoline purchased at Shell stations. Normally, Winn-Dixie spending earns 5 CPG per $50 spent. Unfortunately, only the fee portion of Visa gift card purchases counts. That means that for roughly every $5,000 in manufactured spend, you'll also earn 5 CPG off your next gas purchase (up to 20 gallons). Since I drive a truck with a better than 20 gallon tank, I value that 5 CPG at approx. $1. That return is so minimal that I do not factor it into the "cost" of my spending.

However, for the rest of December, there's a way to juice that return. Fuel Rewards has partnered with Mastercard and is paying a bonus of 3 CPG for every $100 spent at Winn-Dixie (or any other FRN partner store) when you link your Mastercard to your FRN account. I didn't expect that it would work, but in the spirit of scientific inquiry I made a test purchase with my Barclay Arrival card (which is a Mastercard) after linking it to my FRN account. The purchase quickly showed up in my FRN "dashboard", but did not show any fuel rewards earned. However, to my surprise, my account now shows that I earned 30 CPG for the $1,011.90 purchase:

"MasterCard Grocery Bonus 3 cents on $100 $0.30"

Since I value 10 cents in Fuel Rewards at approx. $2 (10 cents x 20 gal.), that means I earned $6 worth of gas on the purchase. This should work with any miles or cashback earning Mastercard once you've linked it to your FRN account and is a nice way to reduce the cost of your manufactured spending for the rest of December.

Winn-Dixie also participates in the Fuel Rewards Network, a loyalty card system that pays off in cents-off per gallon (CPG) of gasoline purchased at Shell stations. Normally, Winn-Dixie spending earns 5 CPG per $50 spent. Unfortunately, only the fee portion of Visa gift card purchases counts. That means that for roughly every $5,000 in manufactured spend, you'll also earn 5 CPG off your next gas purchase (up to 20 gallons). Since I drive a truck with a better than 20 gallon tank, I value that 5 CPG at approx. $1. That return is so minimal that I do not factor it into the "cost" of my spending.

However, for the rest of December, there's a way to juice that return. Fuel Rewards has partnered with Mastercard and is paying a bonus of 3 CPG for every $100 spent at Winn-Dixie (or any other FRN partner store) when you link your Mastercard to your FRN account. I didn't expect that it would work, but in the spirit of scientific inquiry I made a test purchase with my Barclay Arrival card (which is a Mastercard) after linking it to my FRN account. The purchase quickly showed up in my FRN "dashboard", but did not show any fuel rewards earned. However, to my surprise, my account now shows that I earned 30 CPG for the $1,011.90 purchase:

"MasterCard Grocery Bonus 3 cents on $100 $0.30"

Since I value 10 cents in Fuel Rewards at approx. $2 (10 cents x 20 gal.), that means I earned $6 worth of gas on the purchase. This should work with any miles or cashback earning Mastercard once you've linked it to your FRN account and is a nice way to reduce the cost of your manufactured spending for the rest of December.

Tuesday, December 3, 2013

Manufactured Spending- Suntrust Delta Debit Card T&C Change: UPDATE

UPDATE (12/9/13): My November miles posted fine, and it looks as though the language I discuss below has been around for some time for newer cardholders. Points, Miles, and Martinis posted identical T&Cs back in July. So, it appears that this is just a case of Suntrust getting everybody on the same page.

Okay, as promised, I went through the notice I received regarding the new T&Cs for the Suntrust Delta Debit Card, and I'm troubled by what I found.

When I applied for the card back in June 2012, the T&Cs read:

"Only PIN Point of Sale and signature-based purchases (including small dollar purchases that do not require a signature), Internet purchases, phone or mail order purchases or automatic bill payments qualify for mileage earnings. Cash Advances, cash portion of a PIN POS sale with cash back, ATM transactions, payments for stored-value cards, wire transfers, money transfers, quasi cash, or travelers checks do not qualify."

The new language that I received yesterday is almost identical, but the Devil may be in the details. Now the T&Cs read:

"Qualified Purchases: Only PIN Point of Sale and signature-based purchases (including small dollar purchases that do not require a signature), Internet purchases, phone or mail order purchases or automatic bill payments qualify for mileage earnings. Cash Advances, cash portion of a PIN POS sale with cash back, ATM transactions, payments for stored-value cards, wire transfers, money transfers, money orders, cashier checks, quasi cash, travelers checks, purchase of monetary instruments or a PIN POS/signature transaction that contains either in whole or part of one or more of the previously excluded transactions types do not qualify."

The bolded language above reflects the new language in the T&Cs. Notice anything significant there? It's hard to say whether Suntrust will attempt to enforce these terms or, indeed, if it is even possible for them to do so, but I'd say that they are definitely aware of what is going on. I guess we won't know for sure until next month when miles post under the new T&Cs.

Monday, December 2, 2013

Manufactured Spending- Worrisome Rumblings about the Suntrust Delta Debit Card

Today at the lair, I received an envelope from Suntrust Bank. One never likes to get unexpected envelopes from banks, you know. They almost never contain anything good. At best, its some mind-numbing revision of the Bank's privacy policy or some such. At worst it's dire news of ominous portent. Well, that may be the kind of letter I got today. I'm still trying to figure it out

Suntrust has been very generous with their Delta Debit cards. The terms provide that the card earns one Skymile per dollar for all purchases, pin and signature based. That makes for some extremely lucrative miles earning purchases at Wal-Mart, grocery stores, and a few other vendors. Well, the letter I received today indicates that "the terms and conditions that govern the Delta SkyMiles Consumer and Business Check Card" have changed. But after a quick skim of the new T&Cs, I don't see any material changes. I'll compare it to my original T&C tomorrow and hope for the best.

Suntrust has been very generous with their Delta Debit cards. The terms provide that the card earns one Skymile per dollar for all purchases, pin and signature based. That makes for some extremely lucrative miles earning purchases at Wal-Mart, grocery stores, and a few other vendors. Well, the letter I received today indicates that "the terms and conditions that govern the Delta SkyMiles Consumer and Business Check Card" have changed. But after a quick skim of the new T&Cs, I don't see any material changes. I'll compare it to my original T&C tomorrow and hope for the best.

Sunday, November 24, 2013

Small Business Saturday- Registration Open!

Registration opened at midnight last night and, though the offer is smaller this year, free money is free money. Get $10 back on a $10 or greater purchase w/ each of your Amex cards:

https://enroll.amexnetwork.com/US/en/SBS2013/

https://enroll.amexnetwork.com/US/en/SBS2013/

Thursday, November 21, 2013

Peru Rail - What to do When You Forget to Take the Card You Bought the Tickets With

Okay, so I said I'd be covering a couple of my mistakes and what you can do to avoid them, or in the worst-case-scenario, fix them. This was my second mistake, and it was a doozy.

The only way to get to Aguas Calientes, the town at the base of Machu Picchu, is by rail. To carriers run trains along the same line: Peru Rail and Inca Rail. I chose Peru Rail and purchased tickets with no trouble at all... the trouble didn't come until later. You see, for reasons that aren't entirely clear to me, Peru Rail will not allow you to purchase tickets and print them at home. When you purchase tickets, you are given a reservation code that you have to take (along with your passport and the card you bought the tickets with) to a Peru Rail agent. Peru Rail has kiosks at LIM, CUZ, and at the various train stations in the Sacred Valley.

When I left home I was sure that I had taken along the cards I needed for the trip: Amex Plat for lounge access, Priority Pass Card for lounge access, Barclay Arrival Card for travel expenses, Hilton Amex for Hilton charges, Venture Card (for the train), and Sapphire Preferred for restaurants. Well, after the initial debacle getting on to the LIM-CUZ flight we were left with some time to kick around LIM. What luck! There's a Peru Rail kiosk in LIM! I'll just go print my tickets out! Oh, but it was not to be, dear reader...

I got my reservation code and my passport wallet and went to get the tickets. But when I arrived there I opened my wallet to find no Venture card. I tried the cards I'd actually brought with no joy. The agent told me that all he really needed was the last 4 digits from the card and the expiration date. I knew the last 4, but not the expiry. After going through my bag a few dozen times and failing to find the card, I made a guess at the expiry. Again, no joy. (It occurred to me just now to look at my card to see if my guess was right. It was. So obviously just having the last 4 and expiry is no sufficient.) The agent told me that we might be able to resolve the problem by visiting a Peru Rail station in Cuzco ("In Cuzco there is possible solution.") Things were looking bad and Mrs. Pointsninja was not happy with her travel agent (the Points Ninja is not supposed to make travel mistakes). We were supposed to take the train to Machu Picchu the next day, and here we sat sans tickets.

When we arrived in CUZ, I rummaged through my checked bag to see if I'd left the card there. I hadn't. Our driver (Sabino of DUPTours) was at the station to pick us up and I informed him of the slight change of plans: we weren't going to the hotel in Urubamba right away. We need to go to the Peru Rail Station. We ended up at the Estacion Wanchaq, which is closest to the airport and is open until 5PM. There our driver waited while we went into the ticket office at about 4:15. As you enter the ticket office there is a line of desks on the right. They can't help you. You'll actually need to talk to the Customer Service Supervisor who sits in a glass walled cubicle on the left side of the office. We spoke with her, gave her our passports and the reservation number, and explained that I didn't have the card I'd used to purchase the tickets. She asked "why not?" Thinking that "because I'm an idiot" probably wasn't the answer she was looking for, I just explained that I'd accidentally left it back in the States. After a stern look, she said the sweetest words I'd heard in a while: "Okay. I will print the tickets for you."

At last! The clouds parted, bluebirds sang, and, tickets in hand, we finally resumed our trip to Urubamba.

The only way to get to Aguas Calientes, the town at the base of Machu Picchu, is by rail. To carriers run trains along the same line: Peru Rail and Inca Rail. I chose Peru Rail and purchased tickets with no trouble at all... the trouble didn't come until later. You see, for reasons that aren't entirely clear to me, Peru Rail will not allow you to purchase tickets and print them at home. When you purchase tickets, you are given a reservation code that you have to take (along with your passport and the card you bought the tickets with) to a Peru Rail agent. Peru Rail has kiosks at LIM, CUZ, and at the various train stations in the Sacred Valley.

When I left home I was sure that I had taken along the cards I needed for the trip: Amex Plat for lounge access, Priority Pass Card for lounge access, Barclay Arrival Card for travel expenses, Hilton Amex for Hilton charges, Venture Card (for the train), and Sapphire Preferred for restaurants. Well, after the initial debacle getting on to the LIM-CUZ flight we were left with some time to kick around LIM. What luck! There's a Peru Rail kiosk in LIM! I'll just go print my tickets out! Oh, but it was not to be, dear reader...

I got my reservation code and my passport wallet and went to get the tickets. But when I arrived there I opened my wallet to find no Venture card. I tried the cards I'd actually brought with no joy. The agent told me that all he really needed was the last 4 digits from the card and the expiration date. I knew the last 4, but not the expiry. After going through my bag a few dozen times and failing to find the card, I made a guess at the expiry. Again, no joy. (It occurred to me just now to look at my card to see if my guess was right. It was. So obviously just having the last 4 and expiry is no sufficient.) The agent told me that we might be able to resolve the problem by visiting a Peru Rail station in Cuzco ("In Cuzco there is possible solution.") Things were looking bad and Mrs. Pointsninja was not happy with her travel agent (the Points Ninja is not supposed to make travel mistakes). We were supposed to take the train to Machu Picchu the next day, and here we sat sans tickets.

When we arrived in CUZ, I rummaged through my checked bag to see if I'd left the card there. I hadn't. Our driver (Sabino of DUPTours) was at the station to pick us up and I informed him of the slight change of plans: we weren't going to the hotel in Urubamba right away. We need to go to the Peru Rail Station. We ended up at the Estacion Wanchaq, which is closest to the airport and is open until 5PM. There our driver waited while we went into the ticket office at about 4:15. As you enter the ticket office there is a line of desks on the right. They can't help you. You'll actually need to talk to the Customer Service Supervisor who sits in a glass walled cubicle on the left side of the office. We spoke with her, gave her our passports and the reservation number, and explained that I didn't have the card I'd used to purchase the tickets. She asked "why not?" Thinking that "because I'm an idiot" probably wasn't the answer she was looking for, I just explained that I'd accidentally left it back in the States. After a stern look, she said the sweetest words I'd heard in a while: "Okay. I will print the tickets for you."

At last! The clouds parted, bluebirds sang, and, tickets in hand, we finally resumed our trip to Urubamba.

Machu Picchu Mistake Number One- Get to the Airport on Time-Caral Lounge Review

As I mentioned earlier, I made a couple of mistakes on our trip to Machu Picchu. The first was pretty simple. I didn't make allowances for the nightmare that is Lima traffic when trying to make it to LIM airport for a flight. We had tickets for the 10:40 flight from LIM-CUZ and left the hotel at about 9:00. I should have checked in online, as I usually do, but, knowing that we had to check a bag, I didn't. In the end, we didn't arrive at the line for checking baggage until about 9:55, only to be greeted with "The flight closed for check-in ten minutes ago." Ugh!

We went down to another line where we were booked into the next available flight to CUZ: 2:30 PM. Hurrah! Four lovely hours in LIM. At least we were able to use my Lounge Club card to get into the Caral Lounge which was pretty sad, but better than nothing. Bar/drinks/snacks, but very limited seating.

Oddly enough, had I not made the mistake of getting us to the airport late, I might not have discovered my second more important mistake until it was too late. But that's a story for the next post.

We went down to another line where we were booked into the next available flight to CUZ: 2:30 PM. Hurrah! Four lovely hours in LIM. At least we were able to use my Lounge Club card to get into the Caral Lounge which was pretty sad, but better than nothing. Bar/drinks/snacks, but very limited seating.

Oddly enough, had I not made the mistake of getting us to the airport late, I might not have discovered my second more important mistake until it was too late. But that's a story for the next post.

Wednesday, November 20, 2013

Amex Small Business Saturday Sign-Up and Terms

-

How does the American Express Card Member Offer for Small Business Saturday work?

- Card Member registers any eligible American Express Card online at www.shopsmall.com. Registration is limited. Registration opens at 12:00 A.M. MST (Mountain Standard Time) on 11/24/13 and continues until 11:59 P.M. MST on 11/30/13, unless the registration limit is reached sooner.

- Card Member uses the registered Card on 11/30/13 to spend $10 or more in a single in-store transaction at a qualifying small business location that appears on the Small Business Saturday Map. Online transactions do not qualify. The Small Business Saturday Map will be available starting on 11/21/13.

- Card Member will receive a one-time $10 statement credit for that transaction from American Express within 90 days after 11/30/13.

- Registration is limited so encourage your customers to register early before supply runs out.

- Registration opens at 12:00 A.M. MST on 11/24/13 and continues until 11:59 P.M. MST on 11/30/13, unless the registration limit is reached sooner.

- Corporate Cards and all prepaid Card products (other than American Express Serve®) are not eligible for this offer.

- Online purchases do NOT qualify for this offer.

- Single transaction requirement means that, to receive the credit, the transaction must equal $10 or more. For example, if the transaction is only for $5, the Card Member will not receive a credit. Multiple transactions of less than $10 will not qualify even if the combined total of those transactions is more than $10.

- If the qualifying purchase is returned or cancelled, the statement credit may be reversed.

- If American Express does not receive information that

identifies a transaction as having occurred at a qualifying small

business location, the transaction will not qualify for the statement

credit. For example, the following transactions will not qualify for the

credit:

- Transactions made using an electronic wallet or any other transaction made through a third party; and

- Transactions not made directly with the merchant.

Friday, November 15, 2013

Restaurant Huaca Pucllana- Review

We had some great food in Lima (and pretty much everywhere else in Peru), but one restaurant merits a special mention. Restaurant Huaca Pucllana is in the Miraflores district of Lima and sits on the grounds of the eponymous Huaca Pucllana ruins. This was one of the restaurants recommended by the Hilton Miraflores concierge. At first I was leery of the recommendation given that the restaurant was literally inside a tourist attraction, but, after some research, we decided to give it a try. I'm sure glad we did. Restaurant Huaca Pucllana could very easily have been an overpriced tourist trap, but it was the farthest thing from that.

The restaurant has inside or outside seating. We sat outside and our table had a great view of the surrounding ruins.

It wasn't chilly, but the air was just cool enough that I appreciated the braziers burning wood charcoal that were scattered around the outside dining area. I would most definitely recommend sitting outside unless the weather is really terrible. Service was impeccable and the prices were quite reasonable when compared with US restaurant prices. After pisco sours and ceviche, I had a pepper crusted tuna that was cooked a perfect medium and Mrs. Pointsninja had a quinoa-crusted sea bass that was stellar.

We had cocktails, ceviche, entrees, deserts and a bottle of quite-decent Peruvian wine for just over $120 US. Given the quality of the food and the level of service, this was really a steal. After dinner we took a brief tour of the ruins. Tickets for the tour are available at a counter near the kitchen of the restaurant and run about 12 soles ($4) per person. The tour is brief and you don't get to climb the pyramid as you would during the day, but it's really worth doing if you won't get to see the ruins otherwise.

On a final note, we took a hotel car from the Hilton to the restaurant. The charge for the brief taxi ride was around 60 soles. For our return, we got a local taxi from the restaurant's taxi stand. The charge to return to the hotel? 15 soles. Lesson learned.

The restaurant has inside or outside seating. We sat outside and our table had a great view of the surrounding ruins.

It wasn't chilly, but the air was just cool enough that I appreciated the braziers burning wood charcoal that were scattered around the outside dining area. I would most definitely recommend sitting outside unless the weather is really terrible. Service was impeccable and the prices were quite reasonable when compared with US restaurant prices. After pisco sours and ceviche, I had a pepper crusted tuna that was cooked a perfect medium and Mrs. Pointsninja had a quinoa-crusted sea bass that was stellar.

We had cocktails, ceviche, entrees, deserts and a bottle of quite-decent Peruvian wine for just over $120 US. Given the quality of the food and the level of service, this was really a steal. After dinner we took a brief tour of the ruins. Tickets for the tour are available at a counter near the kitchen of the restaurant and run about 12 soles ($4) per person. The tour is brief and you don't get to climb the pyramid as you would during the day, but it's really worth doing if you won't get to see the ruins otherwise.

On a final note, we took a hotel car from the Hilton to the restaurant. The charge for the brief taxi ride was around 60 soles. For our return, we got a local taxi from the restaurant's taxi stand. The charge to return to the hotel? 15 soles. Lesson learned.

Hilton Lima - Miraflores Review

On our first night (well, technically morning, since we arrived at around 1AM) we traveled by Taxi Green from the Lima Airport (LIM) to the Hilton Miraflores. You'll find the general consensus is that Taxi Green (more on them later) is the preferred service for getting from the Airport to anywhere in Lima. The set price was 45 Soles (approx. $18) for the 45 minute cab ride. Miraflores is a fairly well-to-do shopping district and the Hilton (which opened in Dec. 2012) is quite nice. Your first sight on entering the lobby is the massive slate water features flanking the entrance to the bar:

The check-in area is just beyond some comfortable couches where we were seated while our passports were checked. As a Hilton diamond, we were "upgraded" to room 1030, an executive floor room. I was hoping for a better upgrade as many have reported receiving suites at this hotel, but given the short length of our stay and the lateness of the hour, I elected not to make a fuss. Here's a floor plan showing our room outlined in blue:

The room itself was perfectly adequate with modern furnishings in good condition. Just inside the door to the right was a closet with extra pillows and a safe:

To the left was the attractively furnished bathroom with the Hilton's standard Peter Thomas Roth toiletries:

The room featured a king-size bed, desk, and largish flat-screen television.

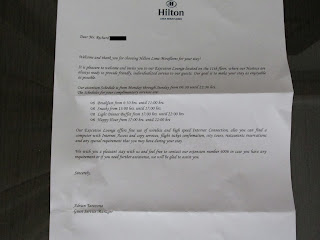

In the room was a letter explaining the lounge hours and services:

Breakfast runs a very generous 6:30 to 11am. Snacks are served from 1pm to 6pm, and complimentary drinks and a "light dinner buffet" are served from 6pm until 10pm. The 10pm closure time doesn't appear to be strenuously enforced, though the staff began removing the food and alcoholic beverages at that time. After crashing for the night, we got up the next morning and went down to breakfast:

The spread was smallish, but the food quality was good. The hot options consisted of a potato dish, an egg dish, bacon, and sausages. The beverages pictured in the fridge below were available all day. Not pictured is an excellent espresso machine that produced quite good coffee drinks. Service was attentive and friendly without being overbearing.

The room is small, but wasn't at all crowded and we had no trouble finding a table by the window. Additional tables are outside, but it was cool and overcast so they were not in use. One item from the buffet that I'd like to mention was some truly excellent local yogurt.

I dearly wish that any variety of US yogurt could approach the quality of this stuff. I've had yogurt in Europe that was almost as good. The days of the Dannon being the only choice are happily behind us, but there is no question that the Obama Administration needs to get to work on the "Yogurt Gap" lest we be left behind in the world.

Outside the lounge was a rooftop deck, a lovely pool, and two hot tubs, all with nice views toward the ocean.

We returned to the lounge that evening for cocktails, but unfortunately I didn't take my camera. The food spread was finger sandwiches, cheeses, fruit, and a couple of hot dishes. The quality was good, but as we were going out to dinner, we didn't have much. The bar consisted of red and white wine and a decent mix of liquor.

On the final morning of our stay we needed to return to LIM. The hotel price for a transfer was around $40, but the desk clerk was happy to call a radio taxi for us. The charge ended up being less than 40 Soles, or about a third of the price of the hotel car.

All in all, I was satisfied with my stay and wouldn't hesitate to stay here again.

EDIT: We didn't eat in the hotel bar or restaurant, but I thought I'd mention a great meal we had at Papacho's a "hamburguesa" restaurant that's in the same building. They have a wide variety of Peruvian influenced hamburgers (all around 30 Soles) that go great with a Sierra Andina beer.

Wednesday, November 13, 2013

Machu Picchu Trip Report Coming Soon- Including Mistakes to Avoid!

Mrs. Pointsninja and I just returned from a trip to Peru and I'll updating soon with reviews of the following hotels: The Hilton Lima- Miraflores, The Tambo Del Inka, and SUMAQ Machu Picchu.

I'll also be sharing other trip experiences, including a couple of mistakes that I made. I'll explain how you can easily avoid them and how I managed to resolve them!

Tuesday, November 5, 2013

New Hilton-American Express Membership Rewards Promo!

One of the least useful Amex Platinum benefits is a subscription to Departures, a glossy travel magazine that offers lots of Swiss watch ads, fashion ads, and articles on expensive vacation destinations, but little else of value. Imagine my surprise when I came across some useful information while flipping through the latest issue!

Amex is partnering with Hilton Honors for a membership rewards promotion and offering bonus MR points for Hilton stays.

I value Membership Rewards points at around 1.4cpp, so while this offer isn't incredible, it's certainly worthwhile to register if you have any upcoming holiday travel that includes a Hilton stay. Of course, because this program is running through Amex, the bonus wouldn't affect your normal points earning with Hilton. Too bad Hilton devalued their award chart so badly last Spring!

The T&Cs aren't entirely clear as to whether this is a one-shot-per-card-deal or if you'll earn the bonus points for more than one stay. The terms provide that "you may register more than one Card for this offer, but only those cards you register will be eligible for the offer." The terms also indicate that "you must make a single purchase of $175 or more at any participating U.S. location...." In the second paragraph the terms state that "Maximum 10,000 extra points per Program account, regardless of the total amount of purchases made in connection with the offer across all Cards that are linked to the same Program account and regardless of the number of stays." So, at the very least, one stay per MR-linked card is eligible for the bonus. I'd assume that includes authorized user cards.

EDIT: Just had a thought. This offer might combine nicely with the Tripadvisor $50 off $250 Amex Travel Sync offer. Maybe I need to stay a US Hilton soon!

EDIT: The list of participating properties is limited to properties in Atlanta, Baltimore, Chicago, Ft. Lauderdale, Hawaii, Houston, Miami, New Orleans, New York, Orlando, Phoenix, San Diego, San Francisco, and Washington, D.C.

Amex is partnering with Hilton Honors for a membership rewards promotion and offering bonus MR points for Hilton stays.

- STEP ONE: "Register any eligible Membership Rewards Program enrolled American Express card at amexnetwork.com/hhonors by 1/31/2014."

- STEP TWO: "Use the same Card that you registered to make a purchase of $175 or more in a single transaction at participating hotels and resorts within the U.S. Hilton Honors portfolio between 11/1/2013 and 1/31/2014."

- STEP THREE: "Get 4 extra points per dollar for all charges, including your room rate, up to a maximum of 10,000 points per Membership Rewards program account."

|

| Offer Terms and Conditions |

I value Membership Rewards points at around 1.4cpp, so while this offer isn't incredible, it's certainly worthwhile to register if you have any upcoming holiday travel that includes a Hilton stay. Of course, because this program is running through Amex, the bonus wouldn't affect your normal points earning with Hilton. Too bad Hilton devalued their award chart so badly last Spring!

The T&Cs aren't entirely clear as to whether this is a one-shot-per-card-deal or if you'll earn the bonus points for more than one stay. The terms provide that "you may register more than one Card for this offer, but only those cards you register will be eligible for the offer." The terms also indicate that "you must make a single purchase of $175 or more at any participating U.S. location...." In the second paragraph the terms state that "Maximum 10,000 extra points per Program account, regardless of the total amount of purchases made in connection with the offer across all Cards that are linked to the same Program account and regardless of the number of stays." So, at the very least, one stay per MR-linked card is eligible for the bonus. I'd assume that includes authorized user cards.

EDIT: Just had a thought. This offer might combine nicely with the Tripadvisor $50 off $250 Amex Travel Sync offer. Maybe I need to stay a US Hilton soon!

EDIT: The list of participating properties is limited to properties in Atlanta, Baltimore, Chicago, Ft. Lauderdale, Hawaii, Houston, Miami, New Orleans, New York, Orlando, Phoenix, San Diego, San Francisco, and Washington, D.C.

Thursday, October 31, 2013

When loyalty points aren't enough... The Barclay Arrival Card and Zeno's Paradox.

This morning The Frequent Miler discussed the pain that comes into every points & miles collector's life when they have to stay at a non chain property that neither accepts nor offers points or miles. Whether it's a B&B, a cruise line, or to use an example Mrs. Pointsninja and I have just encountered, the Peru Rail, sometimes your huge stash of airline and hotel points is just no help at all. That's where cashback travel cards come in.

The most well-known of these cards is the Capital One Venture card, thanks to the Vikings and one of the Baldwin brothers. The card offers a straight 2mpd return, and the miles can be redeemed for a 1cpm rebate against travel purchases paid for with the card. A few years ago the Capital One made a big splash with their "Match My Miles" sign-up promotion in which the sign-up bonus for getting a venture card was up to 100,000 Venture Miles ($1,000). I jumped on that offer for the bonus alone, but since then I've found that my Venture Miles (accumulated primarily through manufactured spending) are a very useful tool in the Pointsninja's utility belt. Enough so that I've actually paid the $59 annual fee to keep the card after the first year.

Yesterday I received the Barclaybank Arrival card that I mentioned the other day, and, looking at the Ts&Cs and the website, the card is even better than I thought. Like the Venture card, the Arrival card earns a straight 2cpd on all spend. Also like Venture Miles, Arrival miles can be redeemed for a 1cpm rebate against travel purchases made with the card. Barclay defines travel purchases as follows:

Now, with the benefit of having the full cardmember agreement an access to the Barclay website, I see that Arrival card redemptions work more like Venture mile redemptions. So, if I redeem 30,000 Arrival miles for a statement credit to cover my $300 stay in Peru, I'll get a nice little rebate of 3,000 miles ($30). Of course, I'll get a 10% rebate when I redeem those miles as well, and so on (though, with apologies to Zeno, I don't expect Barclay to rebate an infinite number of fractional miles). What this means is that the Arrival card give an effective 2.2% rebate. This beats any (non-bonused) cash-back card out there, including the Fidelity Amex (2% straight cashback).

The card currently carries a 40,000 mile sign up bonus for spending $1,000 within 90 days and the annual fee is waived the first year. It looks to be a significantly valuable card from a bank that doesn't have a lot of travel cards.

The most well-known of these cards is the Capital One Venture card, thanks to the Vikings and one of the Baldwin brothers. The card offers a straight 2mpd return, and the miles can be redeemed for a 1cpm rebate against travel purchases paid for with the card. A few years ago the Capital One made a big splash with their "Match My Miles" sign-up promotion in which the sign-up bonus for getting a venture card was up to 100,000 Venture Miles ($1,000). I jumped on that offer for the bonus alone, but since then I've found that my Venture Miles (accumulated primarily through manufactured spending) are a very useful tool in the Pointsninja's utility belt. Enough so that I've actually paid the $59 annual fee to keep the card after the first year.

Yesterday I received the Barclaybank Arrival card that I mentioned the other day, and, looking at the Ts&Cs and the website, the card is even better than I thought. Like the Venture card, the Arrival card earns a straight 2cpd on all spend. Also like Venture Miles, Arrival miles can be redeemed for a 1cpm rebate against travel purchases made with the card. Barclay defines travel purchases as follows:

- A Travel purchase is defined as: Airlines, Travel Agencies & Tour Operators, Hotels, Motels & Resorts, Cruise Lines, Passenger Railways and Car Rental Agencies.

Now, with the benefit of having the full cardmember agreement an access to the Barclay website, I see that Arrival card redemptions work more like Venture mile redemptions. So, if I redeem 30,000 Arrival miles for a statement credit to cover my $300 stay in Peru, I'll get a nice little rebate of 3,000 miles ($30). Of course, I'll get a 10% rebate when I redeem those miles as well, and so on (though, with apologies to Zeno, I don't expect Barclay to rebate an infinite number of fractional miles). What this means is that the Arrival card give an effective 2.2% rebate. This beats any (non-bonused) cash-back card out there, including the Fidelity Amex (2% straight cashback).

The card currently carries a 40,000 mile sign up bonus for spending $1,000 within 90 days and the annual fee is waived the first year. It looks to be a significantly valuable card from a bank that doesn't have a lot of travel cards.

Friday, October 25, 2013

Mini "App-O-Rama" and Planning for Future Travel

If you enjoy traveling in comfort, there are basically two ways that you can do so:

1. Have enough disposable income to pay for first or business class flights and for nice hotels, or

2. Accumulate A LOT of points and miles.

For most people, the second option is the more realistic. Unless you're a frequent business traveler, if you're going to pursue that strategy, the single most important arrow in your quiver is a strong credit score. That's because the easiest way to accumulate miles and points through credit card sign on bonuses and credit card spending. Today I'd like to focus on applications and what they can do for you.

I divide travel related credit cards into three categories; airline cards, hotel cards, and travel reimbursement cards. Airline cards get you there, hotel cards give you a place to stay, and reimbursement cards can cover a lot of your other expenses. In a recent round of applications, I covered all three bases.

When considering new cards, my first stop is usually The Frequent Miler's website. He does a pretty good job of keeping track of the best travel related credit card offers out there. One of the things I appreciate about TFM's site is that he, like Gary at View from the Wing and Lucky at One Mile at a Time, will usually direct you to the best offer out there, rather than simply promoting a referral link that will earn him money. You can find links for all the cards below at TFM.

My first card application was for the Chase United Airlines Explorer card. As TFM points out, the best current offer is 50,000 United miles for spending $2,000 in three months after getting the card. The card has no annual fee for the first year. and, using Manufactured Spending techniques, the initial spending requirement is no problem at all. The card also offers 5,000 miles for adding an authorized user, so ordered one for Mrs. Pointsninja. While I don't have immediate plans for using the miles, they'll go into my existing United stockpile where they'll eventually be used for TATL travel, hopefully in Lufthansa (LH) First Class. At 135,000 miles apiece for LH F, I'll need every mile I can get my hands on!

Second, I addressed the hotel situation. This wasn't a new application, but rather an "upgrade" to an existing card. A couple of years ago, I signed up for the Amex Hilton Surpass card in order to earn Hilton Diamond status. When the annual fee came due, I "downgraded" the card to an ordinary Hilton Amex card, which carries no fee. However, when I logged into my Amex account, their card comparison tool, showed me that I was eligible for a 50,000 point bonus if I "reupgraded" my Hilton card to the Surpass card. I took them up on the offer. I'll end up paying a pro-rated $75 annual fee, but 50,000 points with no hard credit pull is nothing to sneeze at.

Finally, I went for the Barclay Bank Arrivalcard. The card is fee-free the first year and comes with a 40,000 point signup bonus for spending $1,000 in the first three months. The card earns 2ppd that are worth 1cpp when applied to travel expenses, so the bonus amounts to $400 in reimbursable travel expenses. I'll use that for covering things like award booking fees, rental cars, hotel meals, and other miscellaneous expenses that come along with "free travel."

My credit score will likely take a 5-10 point hit for these new applications, but that will drop off in less than a year. Meanwhile, I've earned another 145,000 points and miles for future trips!

1. Have enough disposable income to pay for first or business class flights and for nice hotels, or

2. Accumulate A LOT of points and miles.

For most people, the second option is the more realistic. Unless you're a frequent business traveler, if you're going to pursue that strategy, the single most important arrow in your quiver is a strong credit score. That's because the easiest way to accumulate miles and points through credit card sign on bonuses and credit card spending. Today I'd like to focus on applications and what they can do for you.

I divide travel related credit cards into three categories; airline cards, hotel cards, and travel reimbursement cards. Airline cards get you there, hotel cards give you a place to stay, and reimbursement cards can cover a lot of your other expenses. In a recent round of applications, I covered all three bases.

When considering new cards, my first stop is usually The Frequent Miler's website. He does a pretty good job of keeping track of the best travel related credit card offers out there. One of the things I appreciate about TFM's site is that he, like Gary at View from the Wing and Lucky at One Mile at a Time, will usually direct you to the best offer out there, rather than simply promoting a referral link that will earn him money. You can find links for all the cards below at TFM.

My first card application was for the Chase United Airlines Explorer card. As TFM points out, the best current offer is 50,000 United miles for spending $2,000 in three months after getting the card. The card has no annual fee for the first year. and, using Manufactured Spending techniques, the initial spending requirement is no problem at all. The card also offers 5,000 miles for adding an authorized user, so ordered one for Mrs. Pointsninja. While I don't have immediate plans for using the miles, they'll go into my existing United stockpile where they'll eventually be used for TATL travel, hopefully in Lufthansa (LH) First Class. At 135,000 miles apiece for LH F, I'll need every mile I can get my hands on!

Second, I addressed the hotel situation. This wasn't a new application, but rather an "upgrade" to an existing card. A couple of years ago, I signed up for the Amex Hilton Surpass card in order to earn Hilton Diamond status. When the annual fee came due, I "downgraded" the card to an ordinary Hilton Amex card, which carries no fee. However, when I logged into my Amex account, their card comparison tool, showed me that I was eligible for a 50,000 point bonus if I "reupgraded" my Hilton card to the Surpass card. I took them up on the offer. I'll end up paying a pro-rated $75 annual fee, but 50,000 points with no hard credit pull is nothing to sneeze at.

Finally, I went for the Barclay Bank Arrivalcard. The card is fee-free the first year and comes with a 40,000 point signup bonus for spending $1,000 in the first three months. The card earns 2ppd that are worth 1cpp when applied to travel expenses, so the bonus amounts to $400 in reimbursable travel expenses. I'll use that for covering things like award booking fees, rental cars, hotel meals, and other miscellaneous expenses that come along with "free travel."

My credit score will likely take a 5-10 point hit for these new applications, but that will drop off in less than a year. Meanwhile, I've earned another 145,000 points and miles for future trips!

Wednesday, October 16, 2013

Manufactured Spending with Debit Cards - Square Cash UPDATE

A recent Flyertalk thread clued me in on Square Cash, a new player in the webpayments game. The thread is HERE. Square is a reputable service, and their new offering is a fee-free way to send up to $2,500 per week to anyone. The limiting factor is that payments can only be made with debit cards and not many debit cards award miles or points. Suntrust's Delta debit card is a good option here at 1 Skypeso per dollar, and I plan to try it out.

This may also be a way to liquidate some prepaid debit cards. Early reports indicate that the Paypal debit card works with Square Cash, but other prepaid gift cards are reported not to work.

However you use this service, I advise caution. In my experience Square is quick to jump on perceived "abuse" and close down accounts. Many folks who used Square credit card readers to cash out gift cards in the past were frustrated by account closures and Square's "fraud prevention measure" of holding balances for 30-60 days.

It will be interesting to see how this plays out.

UPDATE: Test transaction has posted as a "Debit Card Purchase." Game on.

This may also be a way to liquidate some prepaid debit cards. Early reports indicate that the Paypal debit card works with Square Cash, but other prepaid gift cards are reported not to work.

However you use this service, I advise caution. In my experience Square is quick to jump on perceived "abuse" and close down accounts. Many folks who used Square credit card readers to cash out gift cards in the past were frustrated by account closures and Square's "fraud prevention measure" of holding balances for 30-60 days.

It will be interesting to see how this plays out.

UPDATE: Test transaction has posted as a "Debit Card Purchase." Game on.

Tuesday, October 15, 2013

Amex Sync Offer- $10 off $50 @ Lowes

Amex continues to deliver with great Sync offers. The best current offer is a $10 statement credit for a $50 purchase at Lowes. You may find the offer by logging into your Amex account and looking under the "My Offers" tab, or, if you've synced your Amex account with Twitter, you can simply tweet something like this:

Tweet#AmexLowes, get $10 back 1x on $50+ in-store/online purchs at Lowe's w/synced Amex Card! RegLtd Exp 11/15Terms:http://amex.co/1aotICA

Amex will send you a confirmation tweet if you've successfully registered, and then its time to save! Of course, there is also a Manufactured Spending aspect to this and many other Sync deals. Lowes has a fairly respectable gift card rack, and carries cards that can either be used for ordinary spending (Amazon) or even resold for a slight profit (gas cards).

Tweet

Amex will send you a confirmation tweet if you've successfully registered, and then its time to save! Of course, there is also a Manufactured Spending aspect to this and many other Sync deals. Lowes has a fairly respectable gift card rack, and carries cards that can either be used for ordinary spending (Amazon) or even resold for a slight profit (gas cards).

Thursday, October 10, 2013

American Express and Tripadvisor Partner Up- $5 Statement Credit.

I'm pleased to read on One Mile at a Time today that Amex and Tripadvisor are partnering up for some promotions. The initial deal is a $5 statement credit for linking your Amex to Tripadvisor and writing your first review. Since I use Tripadvisor anyway, this was a no-brainer for me. Sign-up is here, but is "limited" so get it while you can.

And, looking at the Amex/TA page, it seems that they will be doing some "sync" offers here much like they've done with Twitter and Facebook. The ones currently on offer are quit appealing: $50 back on a $250 Amex travel booking, $10 back on a $50 California Pizza Kitchen purchase, and $25 back on $100 at The Palm. It looks like Amex will continue to be the most generous "free money" card for the near future.

And, looking at the Amex/TA page, it seems that they will be doing some "sync" offers here much like they've done with Twitter and Facebook. The ones currently on offer are quit appealing: $50 back on a $250 Amex travel booking, $10 back on a $50 California Pizza Kitchen purchase, and $25 back on $100 at The Palm. It looks like Amex will continue to be the most generous "free money" card for the near future.

Wednesday, October 9, 2013

Machu Picchu Tickets- or - Machupicchu.gob.pe, I Hate You!

I've been in the process of planning a trip to Peru and the trip's raison d'etre is to take Mrs. Pointsninja to Machu Picchu to see the Ancient Alien artifacts. After all, there is no way that the Incas did all that unassisted. No, it must have been:

Seriously, though, Machu Picchu is an incredible place and we knew that we wanted to tick it off our list. In the past, access to Machu Picchu was essentially unrestricted, but in recent years the Peruvian Ministry of Culture has limited the number of daily visitors to 2,500. Visitors to Huayna Picchu, the mountain that adjoins and overlooks Machu Picchu, are limited to 400 daily. What that means is that its not safe to just show up in Aguas Calientes (the nearest town) and assume that you'll be able to visit the ruins.

So, you need to get tickets first. I'm a modestly seasoned traveler and, at first, it seemed that the process would be straightforward. After all, there is an official Peruvian Ministry of Culture website that does nothing but sell tickets to Machu Picchu and other sites. That website www.machupicchu.gob.pe was the beginning of my downfall.

First of all, the website is in Spanish, of which I have the most modest smattering. But look! Up in the corner is that boon to monoglots, the little flags that let the user select for English. Easy, right? Not so fast! For some (possibly xenophobic) reason, the site will not let you reserve tickets if you choose the English language option. I suppose you could use google translate, but after several abortive attempts to use the English version of the site, I had most of the fields memorized and just went through it in Spanish.

The process of booking tickets on the site is needlessly complex. First, the user selects which site they want to visit. I chose Machu Picchu + Huayna Picchu. Second, the user must make a reservation by inputting their name, age, nationality, and passport number. So long as you're on the Spanish language version of the site, you can then generate a reservation number. The user then has six hours to pay for the tickets or the reservation expires. Prices are in Peruvian Soles and Machu Picchu + Huayna Picchu costs around $52.

Payment requires you to go back to the first page of the website and select the "PAGOS" tab. That tab will prompt you to enter your reservation number which will then take you to the payment processor. However, they only take Visa, and, allegedly, your Visa must participate in "Verified by Visa", a supplemental security program. It seems that this requirement is due to fraudulent use of credit cards to purchase Machu Picchu tickets. However, since your ticket will bear your name and passport number and may not be used by anyone else, the security concern seems rather excessive.

Anyway, businesses and governments have been accepting payments over the web for years, so paying for these tickets should be no problem, right? WRONG. Google "can't pay for machu picchu tickets" then read all the results. <two weeks later> See what I mean? Because I'm a mileage addict, I have visa cards from Chase, Barclays, US Bank, Citibank, and Capital One. I tried them all. None worked. But I'm a persistent guy. So I tried again, and again, and again. For a week. Finally, I started looking for other ways to buy tickets. Most hotels and any tour operator will book tickets for you, for a modest fee. My hotel in Aguas Calientes charges $170 for a (guided) ticket to Machu Picchu. Ay caramba! I tried some more.

Finally, I gave up and decided to go through an agency. But which one to pick? I read many posts on Flyertalk, Tripadvisor, and other sites. I did a lot of googling. Finally, I settled on http://machu-picchu-entrance-tickets.com/ a website operated by the tour company Totally Latin America. I chose them because, at the time, they were the cheapest option I could find. Tickets for Machu Picchu + Huayna Picchu were $74 each. That price has now increased to $82. A ticket for just Machu Picchu is now $72.

The booking process with TLA was fairly smooth, though it cannot be completed on their website. Essentially the website works like an information form in which you provide TLA your desired dates of visit, name, passport #, and a convenient time to call you. Payment is made over the phone. I talked with a friendly British expat who took my payment and got the tickets to me the next day. I'm told that they are looking at making online payments available, but as of press time, that hasn't happened.

In the end, I got the tickets I needed, but I had to pay a bit more than I wanted to. Still, it was certainly less than I could have paid. Small victories, Pointsninja, small victories. Now, having gotten over this hurdle, we're set for our trip and I can't wait to post some spectacular pictures here!

Seriously, though, Machu Picchu is an incredible place and we knew that we wanted to tick it off our list. In the past, access to Machu Picchu was essentially unrestricted, but in recent years the Peruvian Ministry of Culture has limited the number of daily visitors to 2,500. Visitors to Huayna Picchu, the mountain that adjoins and overlooks Machu Picchu, are limited to 400 daily. What that means is that its not safe to just show up in Aguas Calientes (the nearest town) and assume that you'll be able to visit the ruins.

So, you need to get tickets first. I'm a modestly seasoned traveler and, at first, it seemed that the process would be straightforward. After all, there is an official Peruvian Ministry of Culture website that does nothing but sell tickets to Machu Picchu and other sites. That website www.machupicchu.gob.pe was the beginning of my downfall.

First of all, the website is in Spanish, of which I have the most modest smattering. But look! Up in the corner is that boon to monoglots, the little flags that let the user select for English. Easy, right? Not so fast! For some (possibly xenophobic) reason, the site will not let you reserve tickets if you choose the English language option. I suppose you could use google translate, but after several abortive attempts to use the English version of the site, I had most of the fields memorized and just went through it in Spanish.

The process of booking tickets on the site is needlessly complex. First, the user selects which site they want to visit. I chose Machu Picchu + Huayna Picchu. Second, the user must make a reservation by inputting their name, age, nationality, and passport number. So long as you're on the Spanish language version of the site, you can then generate a reservation number. The user then has six hours to pay for the tickets or the reservation expires. Prices are in Peruvian Soles and Machu Picchu + Huayna Picchu costs around $52.

Payment requires you to go back to the first page of the website and select the "PAGOS" tab. That tab will prompt you to enter your reservation number which will then take you to the payment processor. However, they only take Visa, and, allegedly, your Visa must participate in "Verified by Visa", a supplemental security program. It seems that this requirement is due to fraudulent use of credit cards to purchase Machu Picchu tickets. However, since your ticket will bear your name and passport number and may not be used by anyone else, the security concern seems rather excessive.

Anyway, businesses and governments have been accepting payments over the web for years, so paying for these tickets should be no problem, right? WRONG. Google "can't pay for machu picchu tickets" then read all the results. <two weeks later> See what I mean? Because I'm a mileage addict, I have visa cards from Chase, Barclays, US Bank, Citibank, and Capital One. I tried them all. None worked. But I'm a persistent guy. So I tried again, and again, and again. For a week. Finally, I started looking for other ways to buy tickets. Most hotels and any tour operator will book tickets for you, for a modest fee. My hotel in Aguas Calientes charges $170 for a (guided) ticket to Machu Picchu. Ay caramba! I tried some more.

Finally, I gave up and decided to go through an agency. But which one to pick? I read many posts on Flyertalk, Tripadvisor, and other sites. I did a lot of googling. Finally, I settled on http://machu-picchu-entrance-tickets.com/ a website operated by the tour company Totally Latin America. I chose them because, at the time, they were the cheapest option I could find. Tickets for Machu Picchu + Huayna Picchu were $74 each. That price has now increased to $82. A ticket for just Machu Picchu is now $72.

The booking process with TLA was fairly smooth, though it cannot be completed on their website. Essentially the website works like an information form in which you provide TLA your desired dates of visit, name, passport #, and a convenient time to call you. Payment is made over the phone. I talked with a friendly British expat who took my payment and got the tickets to me the next day. I'm told that they are looking at making online payments available, but as of press time, that hasn't happened.

In the end, I got the tickets I needed, but I had to pay a bit more than I wanted to. Still, it was certainly less than I could have paid. Small victories, Pointsninja, small victories. Now, having gotten over this hurdle, we're set for our trip and I can't wait to post some spectacular pictures here!

Friday, October 4, 2013

Vanilla Reload Cards- A New Look and New Security Features

Like many other folks in the points & miles world, I've been using a combination of Vanilla Reload cards and Amex's Bluebird card to "manufacture spending" in order to generate miles and meet initial spending requirements. If you don't already know, Vanilla Reload cards can be bought with credit cards at some locations, most notoriously at some drugstores. VRs can then be used to reload a variety of prepaid debit cards, such as the Bluebird. The Bluebird can then be used to pay off the credit card with which you purchased the VR.

VRs used to look like this:

They are a fantastic tool in the Pointsninja's arsenal (and not just because they can be flung like shurikens at your enemies), at least when you can find them. However, as discussed at length in this Flytertalk thread, VRs have a significant security flaw. When you activate/load the card there is a ten-digit code on the back of the VR that you use to reload your prepaid card. On older VRs, that code is covered by a gray "scratch off" strip. However, as some have observed, the strip can easily be removed with a razor blade or other implement without leaving a mark. Here you can see that I've removed the strip and reattached it to a different location on the card. A criminal could just as easily remove the strip, write down the code, replace the strip, and leave it for an unsuspecting customer to purchase.

Fortunately, Vanilla has finally implemented a better security measure. The new cards look like this:

The security strip on the back of these cards cannot be removed by a razor blade like the old cards could.

This was a much-needed improvement and should help thwart the type of fraud discussed above. Well done, Vanilla.

VRs used to look like this:

They are a fantastic tool in the Pointsninja's arsenal (and not just because they can be flung like shurikens at your enemies), at least when you can find them. However, as discussed at length in this Flytertalk thread, VRs have a significant security flaw. When you activate/load the card there is a ten-digit code on the back of the VR that you use to reload your prepaid card. On older VRs, that code is covered by a gray "scratch off" strip. However, as some have observed, the strip can easily be removed with a razor blade or other implement without leaving a mark. Here you can see that I've removed the strip and reattached it to a different location on the card. A criminal could just as easily remove the strip, write down the code, replace the strip, and leave it for an unsuspecting customer to purchase.

Fortunately, Vanilla has finally implemented a better security measure. The new cards look like this:

The security strip on the back of these cards cannot be removed by a razor blade like the old cards could.

This was a much-needed improvement and should help thwart the type of fraud discussed above. Well done, Vanilla.

Friday, September 20, 2013

Booking BA Shorthaul Awards- my first experience

Like many, I got the Chase BA Visa way back when they were offering a 100K signup bonus. Since then the miles... er, sorry, Avios... have been sitting in my account because I'm too cheap to pay BA's extortionate fuel surcharges. I'd seen several bloggers and commenters mention that Avios were great for shorthaul partner awards, but, until now, I'd not had the opportunity to find out for myself.

I'm currently planning a trip to Peru in a couple of months. My original plan was MGM-DFW-LIM-CUZ on a mix of AA and LAN flights, but AA had no availability for the DFW-LIM segment. So, I searched Delta and after a little wheeling and dealing, I had enough Skymiles for MGM-ATL-LIM. The problem was that Skyteam had no partners offering the LIM-CUZ route. So, it was back to OneWorld and LAN.

Unfortunately, neither the AA nor BA websites would allow me to search for LAN availability intra-Peru. So, I went to the phones. AA had the flights I needed for 24K + around $50. Not bad, but I decided to see if BA could beat it. I called up and, Bob's your uncle, had two RT tickets for LIM-CUZ at a smashing $27.30tax + 18k Avios. Deal! It's sad when I'm happy about getting just over 2cpm value out of my miles. Interestingly, I was prepared for a $25 telephone booking charge that the BA website warned me about. However, I was not charged the fee for whatever reason. Now if I can just figure out the bloody Machu Picchu ticket website!

I'm currently planning a trip to Peru in a couple of months. My original plan was MGM-DFW-LIM-CUZ on a mix of AA and LAN flights, but AA had no availability for the DFW-LIM segment. So, I searched Delta and after a little wheeling and dealing, I had enough Skymiles for MGM-ATL-LIM. The problem was that Skyteam had no partners offering the LIM-CUZ route. So, it was back to OneWorld and LAN.

Unfortunately, neither the AA nor BA websites would allow me to search for LAN availability intra-Peru. So, I went to the phones. AA had the flights I needed for 24K + around $50. Not bad, but I decided to see if BA could beat it. I called up and, Bob's your uncle, had two RT tickets for LIM-CUZ at a smashing $27.30tax + 18k Avios. Deal! It's sad when I'm happy about getting just over 2cpm value out of my miles. Interestingly, I was prepared for a $25 telephone booking charge that the BA website warned me about. However, I was not charged the fee for whatever reason. Now if I can just figure out the bloody Machu Picchu ticket website!

Friday, September 13, 2013

IC Chicago- The Magnificent Mile

I recently had a memorable stay at the IC Chicago- Magnificent Mile when I was in town for a Cubs game. I've stayed here a couple of times before, and, to me, this is one of those ICs that I really enjoy despite some serious shortcomings. The property is divided between the historic tower and the "Grand Tower" a newer addition. The historic tower originally housed the Medinah Athletic Club (affiliated with the Shriners) in the Thirties. The typical Shriner stylized "middle eastern" architectural details are present throughout the historic building. The pool area is particularly amazing in it's ornamentation.

One high point is that, as an RA, I've received some really great upgrades here when booking the lowest rate available. Last time I was there, I was upgraded to a one bedroom suite on the 38th floor of the historic tower. I was hoping for that upgrade again, but I was surprised with a different upgrade to room 4100, a memorable room on the 41st floor of the historic tower. More accurately, I should say that my room was the 41st floor, since it occupied the entire floor.

One high point is that, as an RA, I've received some really great upgrades here when booking the lowest rate available. Last time I was there, I was upgraded to a one bedroom suite on the 38th floor of the historic tower. I was hoping for that upgrade again, but I was surprised with a different upgrade to room 4100, a memorable room on the 41st floor of the historic tower. More accurately, I should say that my room was the 41st floor, since it occupied the entire floor.

|

| Fire Escape Map |

Thursday, September 12, 2013

Chase INK cards

A while ago, I mentioned that Chase INK cards offered a rare, but useful, benefit to cardholders traveling to Ireland: CDW coverage. Most cards don't offer this, but INK, being a World Mastercard, does. Well, the writing is on the wall that this may be going away.

Today, Gary at View from the Wing has an interesting post on Chase's decision to issue Visa-branded cards to new INK applicants. He mentions, however, that current cards will remain Mastercards. I'm not so sure about that. There are some hints that Chase will also be transitioning current MCs to Visa. Ink's "Think Tank" survey community recently hosted a survey regarding different formats for a letter informing current cardholders that their MC would be switching to a Visa. Chase is at least thinking about it.

Either way, the card remains a very attractive option for earning points, but I'll be sad to see that CDW benefit go away.

Today, Gary at View from the Wing has an interesting post on Chase's decision to issue Visa-branded cards to new INK applicants. He mentions, however, that current cards will remain Mastercards. I'm not so sure about that. There are some hints that Chase will also be transitioning current MCs to Visa. Ink's "Think Tank" survey community recently hosted a survey regarding different formats for a letter informing current cardholders that their MC would be switching to a Visa. Chase is at least thinking about it.

Either way, the card remains a very attractive option for earning points, but I'll be sad to see that CDW benefit go away.

Tuesday, September 3, 2013

Discover Checking- Targeted Offer

I've had a Discover card for many years, and, frankly, I keep it for only three reasons: 1) no annual fee, 2) it's my oldest account; and 3) the occasionally useful 5% cashback offers. Now, it appears that Discover is getting into the banking game in a more concrete way. Today I received an apparently targeted offer to sign up for a Discover checking/debit account. It's advertised as "no monthly fees (no balance or activity requirements)." That's nice, but I already have a checking account.

So, why would I even consider this account? Discover Cash Back. I mean, I've got to pay fuel surcharges and taxes somehow, right? So, I was very intrigued to see that Discover is offering cash back in connection with this checking/debit account. Specifically, the offer is 10 cents per debit purchase, 10 cents per online bill pay, and 10 cents per check written. That really got my gears turning. 1000 $1 Amazon payments? 10,000 10 cent Amazon payments? How long could I possibly last before an account shutdown for "perk abuse?"

I'm guessing the answer is "not long." Looking at the sign-up website, I see this in the FAQ:

I guess Discover learned something from the Citi Thank You point debacle. Anyway, it might be interesting to find out where the "irregular activity" line lies.

So, why would I even consider this account? Discover Cash Back. I mean, I've got to pay fuel surcharges and taxes somehow, right? So, I was very intrigued to see that Discover is offering cash back in connection with this checking/debit account. Specifically, the offer is 10 cents per debit purchase, 10 cents per online bill pay, and 10 cents per check written. That really got my gears turning. 1000 $1 Amazon payments? 10,000 10 cent Amazon payments? How long could I possibly last before an account shutdown for "perk abuse?"

I'm guessing the answer is "not long." Looking at the sign-up website, I see this in the FAQ:

"Can I earn more rewards by splitting up my normal bill payments or debit card transactions?

Your bill payments, debit card transactions and checks are rewarded for normal everyday transactions. As noted in the Deposit Account Agreement, we reserve the right to adjust the amount of your rewards or close your account due to irregular, unauthorized or fraudulent activity in your Checking Account. For example, splitting up one standard monthly bill payment into several payments to receive $0.10 per payment is deemed as irregular activity as it's not standard bill payment practice. Same holds true for debit card transactions. Asking a merchant to swipe your debit card repeatedly for each item at checkout instead of using your debit card to make a complete purchase of items at one time is recognized as manufacturing transactions and not normal everyday debit card behavior."I guess Discover learned something from the Citi Thank You point debacle. Anyway, it might be interesting to find out where the "irregular activity" line lies.

Friday, August 16, 2013

"Moments by SPG" - Seeing the Cubs from Starwoods Luxury Box

Its fairly axiomatic that the way to obtain the best value when using points or miles in any particular program is to redeem those points as a "native currency", that is to say, using miles to book flights and points to book hotel rooms. Many programs will try to tempt you to use your points for merchandise, a notoriously bad option that is scorned by all right thinking people.